Roth Ira Income Limits 2024 Phase Out. One key aspect of maximizing the benefits of a roth ira is understanding the contribution limits and income restrictions set by the irs. 401 (k) contribution limits 2024.

You can contribute to an ira at any age. The annual contribution limit to an ira has been raised to $7,000.

If You Are Under Age 50, You May Contribute $7,000 A Year.

If you're age 50 and older, you can add an extra $1,000 per year.

Basically, You Can Contribute $500 More To Your Ira In 2024 (And $3,000 More To A Sep Ira).

Make the most of bigger contribution limits and.

Roth Ira Income Limits 2024 Phase Out Images References :

Source: anitajulienne.pages.dev

Source: anitajulienne.pages.dev

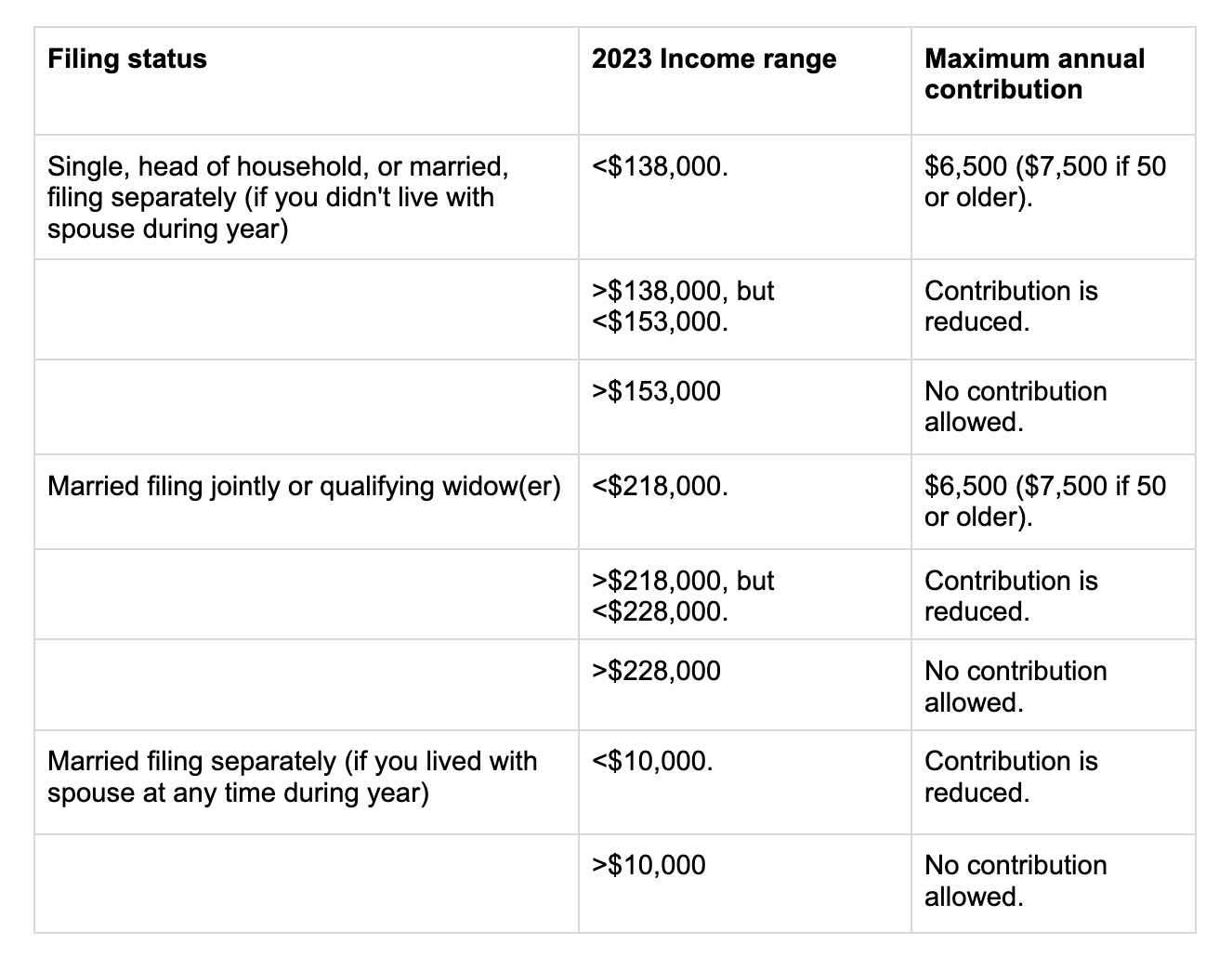

Ira Limits 2024 For Conversion Alice Babette, They indicate how much you can contribute to a roth, if at all, and they apply whether or not you participate in a 401(k). You may contribute simultaneously to a traditional ira and a roth ira (subject to eligibility) as long as the total contributed to all (traditional or roth) iras totals no more than $7,000 ($8,000 if you’re age 50 or older) for the 2024 tax year.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, A roth ira phaseout limit is the income level at which your contribution can be reduced or phased out completely. You can also contribute the full $7,000 to a roth ira for 2024 before the tax filing deadline (april.

Source: zorinawshawn.pages.dev

Source: zorinawshawn.pages.dev

What Is The Maximum Roth Contribution For 2024 Rosie Claretta, Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth accounts. Those are the caps even if you.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, Roth contribution phases out entirely for income. In 2024, you can contribute up to $7,000 to a traditional ira or roth ira, a $500 increase from 2023.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Roth IRA Contribution Limits 2022 & Withdrawal Rules, Roth ira income limits for 2024 while you can’t take a tax deduction on a roth ira because contributions are made after tax, roth iras have income limits as well: You’re allowed to increase that to $7,500 ($8,000 in 2024) if you’re age 50 or older.

Source: moneywithkatie.com

Source: moneywithkatie.com

The Backdoor Roth IRA — Millennial Money with Katie, If you’re at least 50 years old you can save an additional. Make the most of bigger contribution limits and.

Source: rethaqmartie.pages.dev

Source: rethaqmartie.pages.dev

Ira Contribution Phase Out Limits 2024 Tresa Harriott, One key aspect of maximizing the benefits of a roth ira is understanding the contribution limits and income restrictions set by the irs. The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000.

Source: biddyloralyn.pages.dev

Source: biddyloralyn.pages.dev

Sep Ira Contribution Limits 2024 Eryn Stevena, For example, say that you exceed your roth limits in 2024. One downside is that you can’t save as much in an ira as you can in a workplace retirement plan.

Source: laneymelonie.pages.dev

Source: laneymelonie.pages.dev

Roth Ira Contribution Limits 2024 Irs Clarey Lebbie, Make the most of bigger contribution limits and. The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Source: sibylqmadlen.pages.dev

Source: sibylqmadlen.pages.dev

2024 Roth Limits Tanya Eulalie, Roth iras have income limits and roth 401(k)s do not. One downside is that you can’t save as much in an ira as you can in a workplace retirement plan.

Learn About The Roth Ira Income Limits For 2024, Including Updates And Strategies For Maximizing Your Contributions And Retirement Savings.

You can make 2024 ira contributions until the unextended federal tax deadline (for income earned in 2024).

If You Are 50 And Older, You Can Contribute An Additional $1,000 For A Total Of $8,000.

However, keep in mind that your eligibility to contribute to a roth ira is based on your income level.

Category: 2024